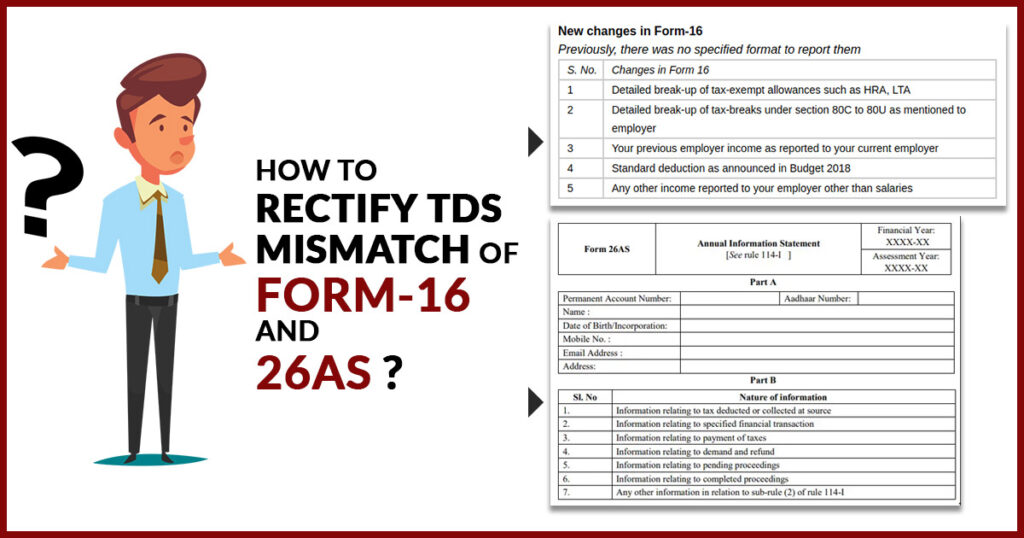

Procedure to Download Form 26AS from ITR Filing Portal V2.0

Form 26AS has all the required details of tax deducted concerned with the taxpayer by the deductor i.e. bank, employer etc. Therefore all the deductions of TDS which are shown up in the Form 16A/Form 16 can be cross verified by the means of Form 26AS. It is to be noted that the amount of TDS should …

Procedure to Download Form 26AS from ITR Filing Portal V2.0 Read More »